Rent or Buy?

Rent or Buy?

To Rent or Buy?

GLS within the context of the South Africa market is unique in that we are positioned to support both options of whether our current and future clients want to either rent or buy returnable supply chain equipment.

As our extensive product and solutions portfolio caters for both, we are not biased to promote one over the other. Giving our clients the comfort and flexibility needed to adhere to their specific needs.

Our team of professional packaging and pooling experts will build the business case that has our prospective client’s best interest at the core of any of our proposals. Our business is creating value in the supply chain through innovative equipment solutions. To Rent Or Buy

We understand that every supply chain is unique and consequently it’s imperative to factor in several variables when evaluating the benefits of ownership versus outsourcing. Let’s consider these more carefully .

Product/ Program Life Cycle

If the intended program has the following attributes:

- Five year plus initiative.

- Returnable transit packaging is used primarily for in-house storage and work in progress.

- Short proximity closed-loop supply chain that requires minimal asset management and equipment maintenance.

If the criteria above are met, then our recommendation to clients would be to buy in their requirement. The business case just doesn’t make sense to rent, except if there are capex limitations.

In this case we offer all our customers who purchase equipment through us the opportunity to include a ‘buy-back’ clause should they want to switch to a rental solution later. The key motivator for a ‘sell and rent’ decision is to release cash back into to business to be utilized elsewhere.

Equipment Maintenance

Every returnable equipment material type be it, metal, wood and plastic, all have different maintenance and repair attributes necessary to meet or extend their targeted life cycle. Average equipment damage rates drive the level of infrastructure investment required and need to be carefully considered when developing an equipment strategy.

In our experience most companies that buy returnable equipment make the wrong assumptions related to the rate of equipment damage and tend to under invest in in-house competencies. It consequently leads to repair backlogs that negatively impacts equipment availability, which directly affects day to day operations.

This results in operations requesting additional CAPEX to procure new equipment to sustain required service levels and undermines the original motivation of the business case to buy rather than rent.

In-house Asset Management Capabilities

Managing returnable equipment is like a black art. Most companies don’t understand how easy it is to lose them. When you lose equipment, someone pays and keeps paying in the hope they will get them back, and they invariably don’t. The second aspect that is overlooked it the cycle time of equipment through the supply chain. Companies end up over capitalizing on equipment due to a lack of transparency and utilization.

Equipment tracking, cleaning, repair, reverse logistics, storage, and management focus are all core competencies required to effectively manage a large-scale reusable packaging program.

Unless you are prepared to invest in the necessary support, it is our recommendation that you outsource this responsibility to GLS who has invested and developed the appropriate systems and processes over the last 10 years.

Capital And Cost Of Capital

As the saying goes, ‘Cash is king’ and if cash is limited, we suggest customers will want to consider other third-party ownership options that won’t tap your balance sheet and strain your available resources.

Supply Chain Route To Market

Supply chains that are a simple one to one relationship in a closed loop, leans towards an ownership model. As supply chains evolve and become more complex, it becomes more difficult to apply the right level of focus and resources to running an efficient reusable program. Third-party poolers like GLS have the systems, processes, and logistical capability necessary to support any reusable program type.

Production / Price Volatility

The size of returnable equipment pools have to be large enough to meet seasonal peaks. If seasonal high and low variances are significant either a pooled solution or mix between owned and pooled be considered. This potentially would save customers from a large capital expense for packaging that might sit idle for periods of time.

It also protects them from volatile packaging raw material prices for wood, steel, or resin.

Program Deployment

Implementing returnable equipment into your supply chain will have a significant impact on your company (e.g., operations, sales, logistics, etc.). If your company is new to reusables, it will be critical to educate ALL of the proper stakeholders to ensure you have proper buy-in before implementation. The purpose of reusable packing is to be cheaper than one-way packaging. This should be the key motivator when deciding between the two options. To determine the actual trip cost of reusable packaging requires thorough analysis and understanding of product flows through the various nodes of the supply chain. If your trip cost increase by as little as R0.50 ($0.035) on 30 million cycles, you will lose R15 million rand ($1 million). Therefore, it is extremely important to understand the intricate dynamics of pooling equipment and better to partner with a specialist company.

If your company has already invested in your own returnable equipment or outsourced this to another third-party provider, GLS has the insight and expertise to benchmark your internal stats, KPI’s and consider ways to gain more return on your investment and improve operational efficiency.

Gavin Keen – GLS Strategy Executive

Recent Posts

Are your pallet rental costs burning a hole in your pocket?

By Gavin Keen New pallets & rental pallets in the last 24 months have all increased significantly due to the

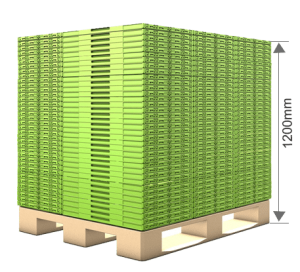

Unlock Significant Benefits With The GLS Attached Lid Container Range

By Gavin Keen The GLS Attached Lid Containers (ALCs) or Tote bins feature an integral hinged lid and provide

Rent or Buy?

To Rent or Buy? GLS within the context of the South Africa market is unique in that we are positioned

Control Ratio

Pallets are like a black art. People don’t understand how easy it is to lose pallets.

Are your pallet rental costs burning a hole in your pocket?

By Gavin Keen New pallets & rental pallets in the last 24 months have all increased significantly due to the

Unlock Significant Benefits With The GLS Attached Lid Container Range

By Gavin Keen The GLS Attached Lid Containers (ALCs) or Tote bins feature an integral hinged lid and provide

Rent or Buy?

To Rent or Buy? GLS within the context of the South Africa market is unique in that we are positioned